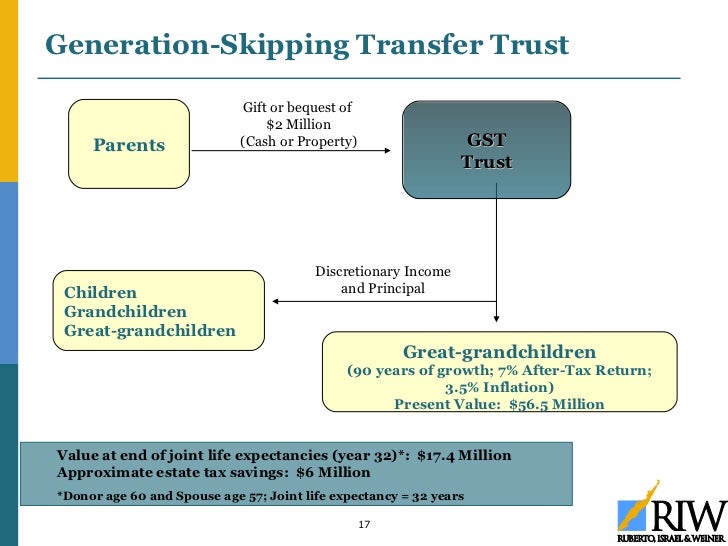

41 generation skipping trust diagram

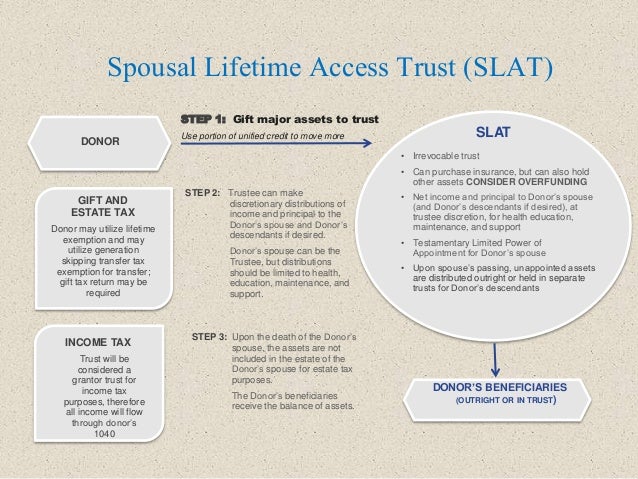

The changes in the 2012 Tax Relief Act for estate, gift, and generation-skipping transfer taxes were made permanent. The estate and gift tax system will continue to be unified. The exclusion and rates for gift and generation-skipping transfer taxes are the same now as the estate tax exclusion and rates. IV. The generation skipping tax exemption is $5,450,000 (adjusted for inflation each year) as is the gift tax exclusion exemption. In the case of a transfer to a trust which will continue for one or more generation members below that of the grantor, a gift tax return should be filed and generation skipping tax exemption shall be allocation.

A generation-skipping trust is a useful tool for those with especially large estates. It allows you to give money directly to younger friends or family members, saving your family some estate tax payments down the line. Up to $11.40 million per person is subject only to the estate tax, while any funds greater tjam that amount are also subject ...

Generation skipping trust diagram

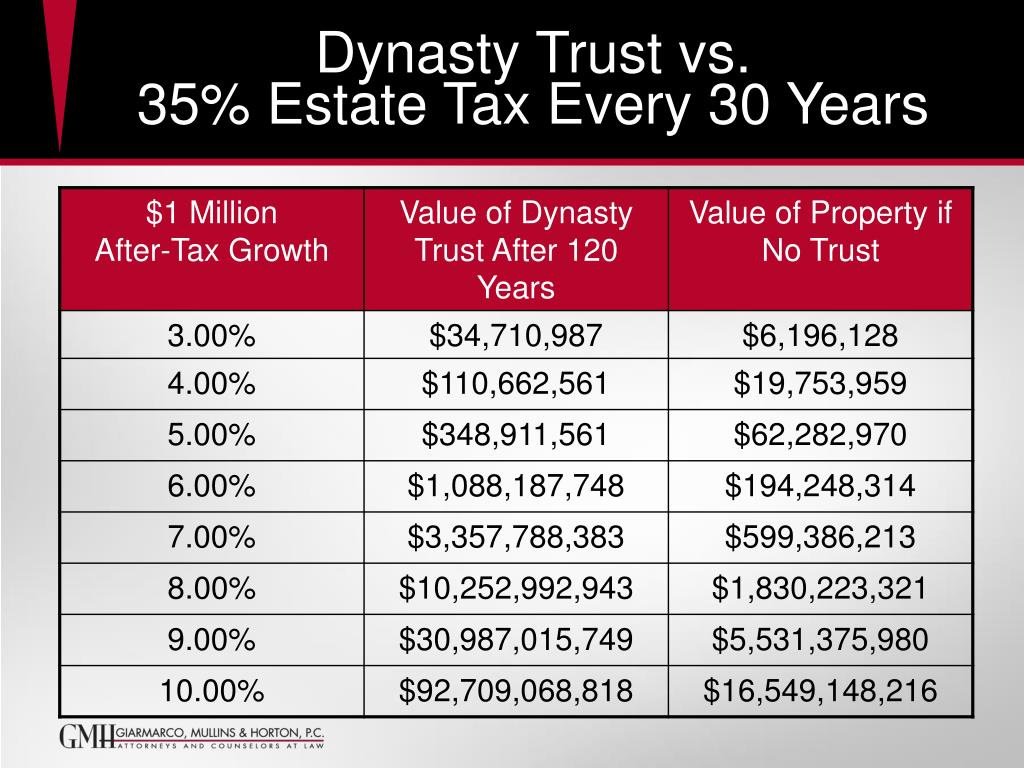

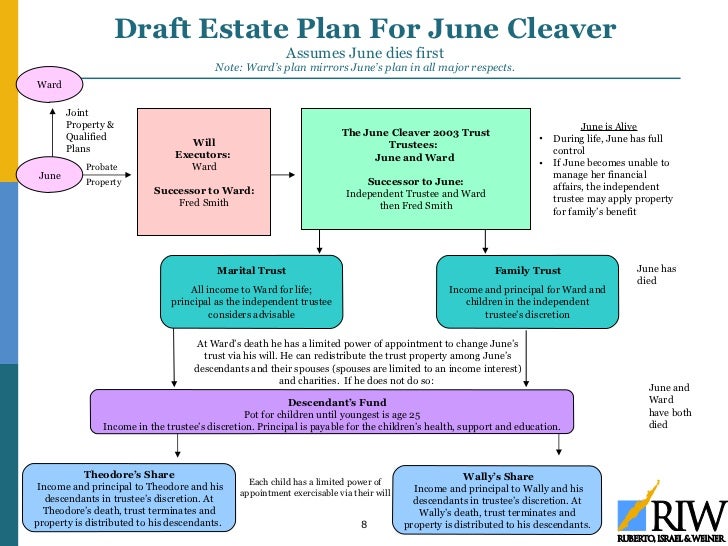

A generation-skipping trust is an estate planning tool designed to transfer assets in a way that avoids some estate taxes. This type of trust, through which assets skip a generation, is also called a GST trust or dynasty trust, because it is often used by affluent families to pass down wealth at a great estate tax savings. The Act left portability unchanged. If a spouse dies without exhausting his or her lifetime gift and estate tax exemption, so long as the decedent's executor makes the proper election on an estate tax return, the unused exemption is credited or "ported" to the surviving spouse for use during life or at death. The generation-skipping tax exemption is a flat $5.25 million this year (it is also indexed for inflation). if you and your spouse are worth more than about $5 million AND you plan on leaving your assets to grandchildren, or in trusts for your children lasting past their deaths, then you might not want to rely on the portability arrangement.

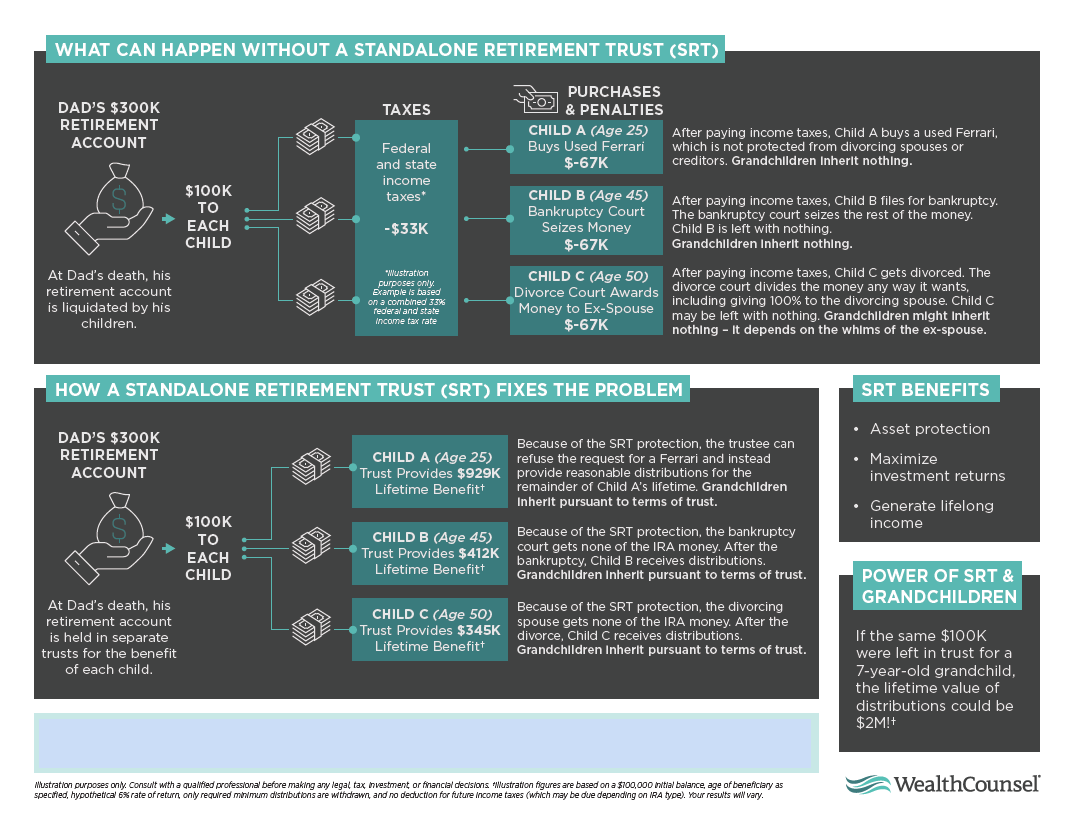

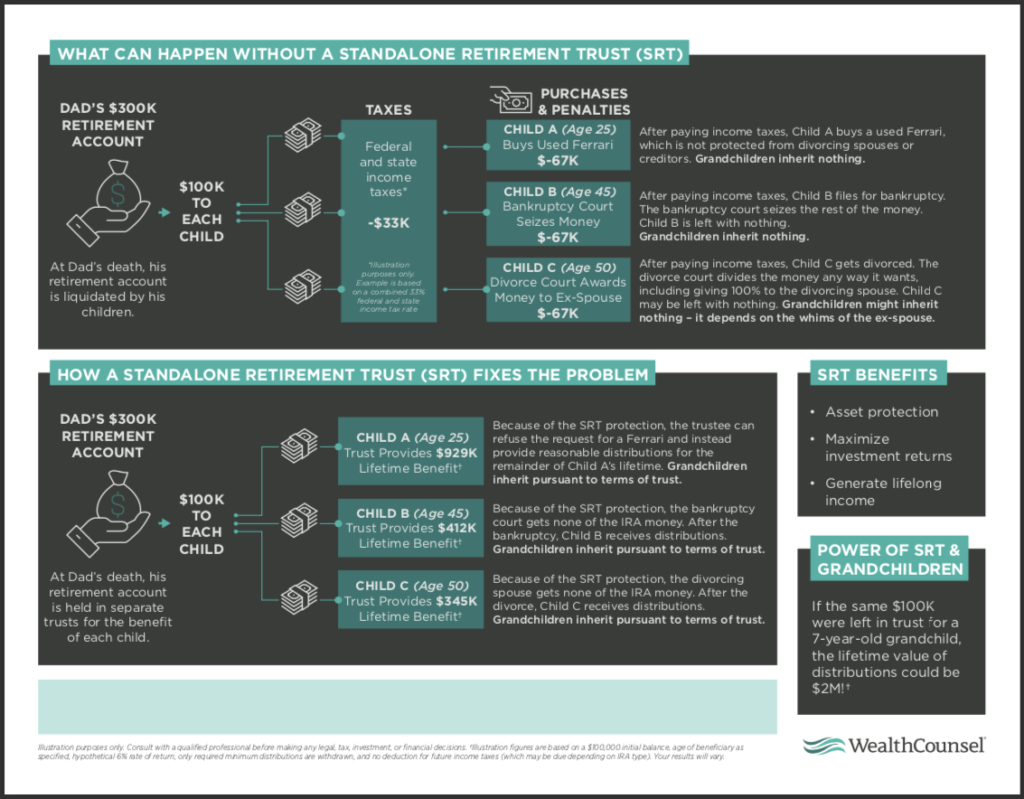

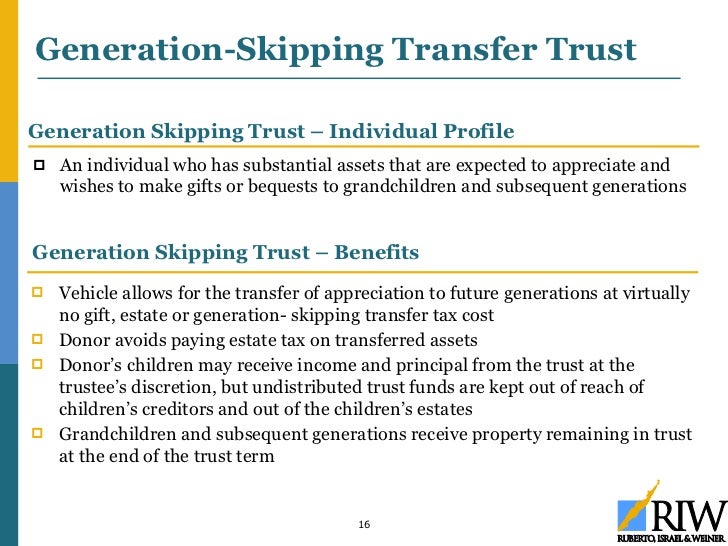

Generation skipping trust diagram. When it comes to estate planning, there are several different types of trust available. Deciding which type of trust you need to accomplish your goals can If you have heard of a QTIP trust and a bypass trust, you may be wondering which one is best. Our trust attorneys can help you make this important choice. Therefore, without the use of a CST, any unused state estate tax exclusion and generation-skipping transfer tax exclusion of the first spouse to die will be lost. Assets contained in a trust are generally protected from the beneficiary's creditors. A generation-skipping trust (GST), sometimes referred to as a “dynasty trust,” is exactly what it sounds like – a legally binding, specialized, irrevocable trust agreement in which a grantor’s assets are passed down to the grantor’s grandchildren (not children) to avoid estate tax liability. GSTs are designed to eliminate estate taxes at each generational level for as many generations as tolerated by applicable Illinois law. A generation-skipping trust is a type of trust that designates a grandchild, great-niece or great-nephew or any person who is at least 37 ½ years younger than the settlor as the beneficiary of the trust. The goal of a generation-skipping trust is to eliminate one round of estate tax. Generation-skipping trusts offer tax advantages through the ...

A generation-skipping trust (GST) is a type of legally binding trust agreement in which the contributed assets are passed down to the grantor's grandchildren, thus "skipping" the next generation, the grantor's children. By passing over the grantor's children, the assets avoid the estate taxes—taxes on an individual's property upon his or her death—that would apply if the children directly inherited them. Generation-skipping trusts are effective wealth-preservation tools for individuals with significant assets and savings. trusts can exist without the trust or beneficiaries paying US federal estate, gift, or generation-skipping transfer tax. However, to date, such efforts have been unsuccessful and the GRAT lives on as a popular and effective estate planning tool. The 1986 Act imposed a tax equal to the highest estate tax rate on any generation- skipping transfer, with a $1 million exemption per taxpayer. In 1995, the exemption was indexed for inflation in $10,000 increments. In 2001, the exemption was increased to match the estate tax exemption. This change, along with scheduled increases in the ... That’s what a “Generation-Skipping Transfer” Trust, or “GST” trust does. It is a trust which is designed to avoid estate taxation at the death of the beneficiary. During the life of the beneficiary, the assets in the trust are used for their health, education, maintenance, and support.

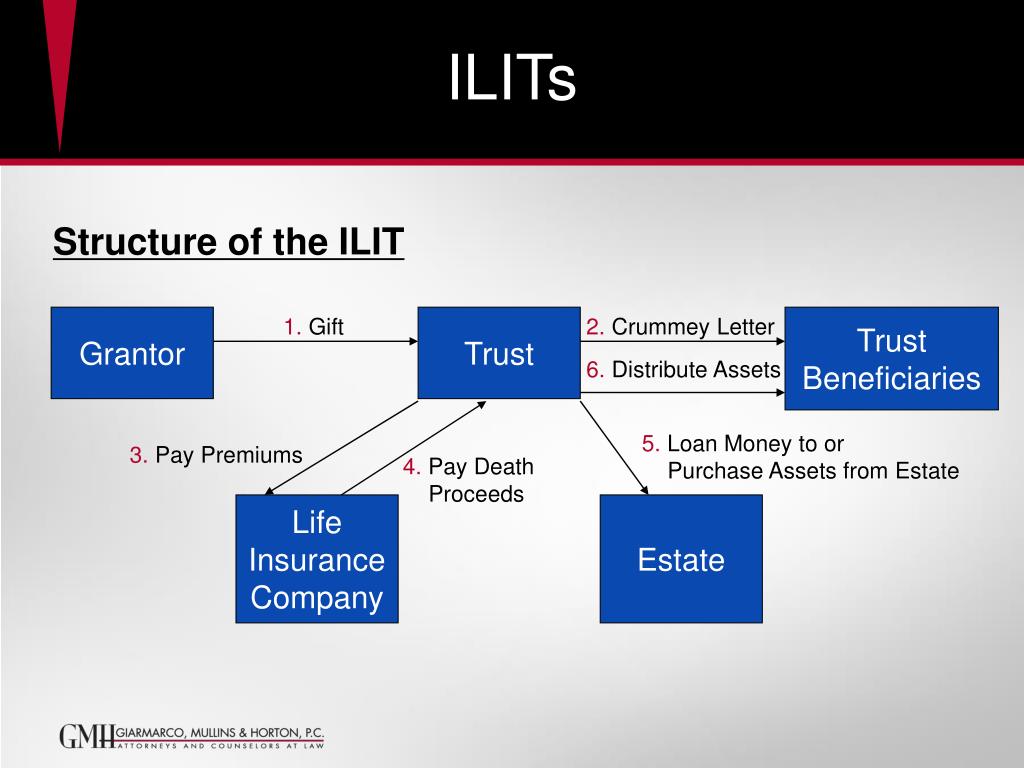

Grantor Trusts. Our service platform offers fourteen (14) different Grantor Trust plans, including six (6) Revocable Living Trust formats. This availability allows our processing offices and network attorneys to address essentially every family planning contingency to meet the goals and objectives of each application submitted to our office. trust to pay the premiums may qualify for the gifting and generation skipping transfer tax exemption—and the death proceeds payable to the trust pass outside of the grantor's estate, as well as the estates of the future descendents covered by the dynasty trust. Because income generated within a dynasty trust is more heavily The Current Law. Thanks to recent changes in the tax law, each person may now transfer approximately $11.2 million free of this generation skipping tax. For a married couple, the amount is effectively $22.4 million. The maximum tax rate for GST, Gift and Estate taxes is now 40%. Combined Tax Rates. In the event GST tax is imposed together with ... Note, however, that the beneficiary need not be a grandchild in order for the IRS to classify a trust as generation skipping. Under IRS rules, a trust skips a generation anytime the beneficiary is ...

What Is a “Generation-Skipping Trust”, and Why Should I Use One for a Portion of My Child’s Inheritance? McDonald & Kanyuk, PLLC January 2014 Some trusts are known in tax jargon as “generation-skipping trusts”. Portions of ARTICLE Iof your revocable trusts use generation-skipping terminology, including “skip

03.12.2021 · (1) Parent generation (2) F1 generation (3) F2 generation. In this case, the first generation above would produce only pink flowers since all offspring would get one version of each gene. But if you crossed those F1 plants together, you would get a 25% chance of getting white or red, and a 50% chance of getting pink flowers.

The generation-skipping tax exemption allows you to leave a certain amount in trust for your beneficiaries so that these inheritances are not taxed again when the beneficiaries die. Despite talk that both the estate tax and generation-skipping tax might be eliminated, this change does not appear likely.

In this post, I define a skip person for purposes of the generation-skipping transfer tax.For more detailed information, please see my book, The Simple Guide to Estate Planning: A Look at Wills, Trusts, and Taxes. Photo by Eric Hunsaker is licensed under CC 2.0.This content uses referral links. In a previous post, I discussed the generation-skipping transfer tax (GST).

Transmitter. The transmitter includes the Bit Generation subsystem, the QPSK Modulator block, and the Raised Cosine Transmit Filter block. The Bit Generation subsystem uses a MATLAB workspace variable as the payload of a frame, as shown in the figure below. Each frame contains 20 'Hello world ###' messages and a header. The first 26 bits are header bits, a 13-bit Barker …

13.12.2021 · News you can trust since 1873. ... and help foster the next generation of talent. ... Home exercise gear that works: weighted hula-hoops, bala …

For years, married couples have used AB trusts to maximize the amount of assets they pass to their heirs free of estate tax. See this AB trust diagram for a refresher on how AB trusts work. When the estate tax exemption amount was only $2,000,000 per person several years ago, an AB trust arrangement was necessary just to pass $4,000,000 to heirs fee of estate tax.

and generation skipping taxes) are completely different laws. As such, the concept of "ownership" is different for the two laws. Therefore, we have a trust - a grantor trust - which can be "owned" by the grantor under one law - the income tax law - and yet not owned by the grantor under the other group of laws - the transfer ...

Integrated Trust Systems.

0 Response to "41 generation skipping trust diagram"

Post a Comment