38 call option payoff diagram

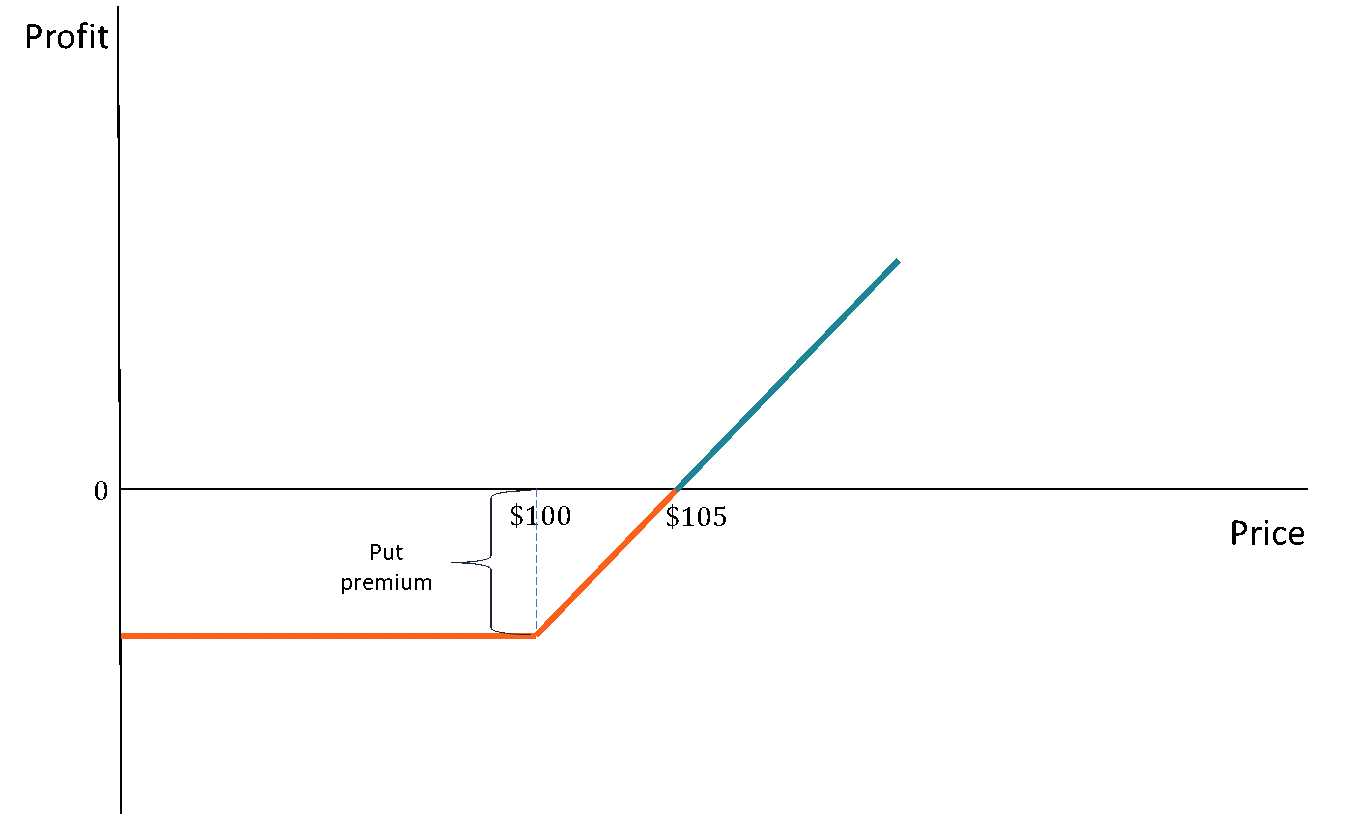

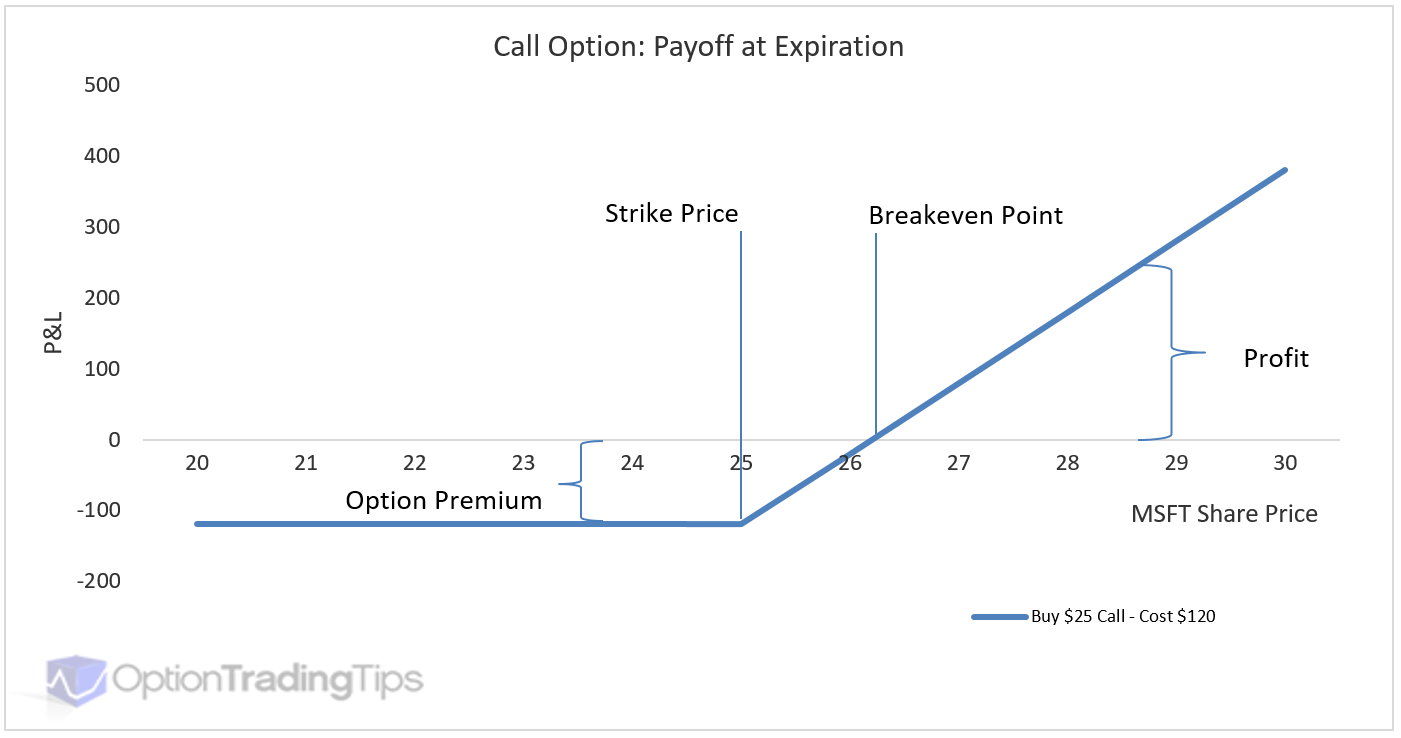

Call options tend to be purchased by investors who hold a bullish view on the underlying, while a bearish view would be expressed by buying a put option. As a result, the option seller will have the converse payoff profile to the option buyer, and the sum of the positions of buyer and seller is zero. This means the maximum profit and maximum ... Profit & loss diagrams are the diagrammatic representation of an options payoff, i.e., the profit gained or loss incurred on the investment made. The diagram below shows a profit and loss diagram for a "long call option.". The vertical axis indicates the profit/loss earned or incurred. All amounts above zero level represent a profit earned ...

Selling a Call Payoff. When we reverse the position and sell a call option, here is the payoff diagram for that. We have the same format of stock price on the x-axis (horizontal) and P&L on the y-axis (vertical). Because we sold the call, we receive money for the sale, which is the premium.

Call option payoff diagram

1, Payoff Diagram on a Call Option. 2, Current Stock Price = $ 3, Strike Price of Option = $ 4, Price of the Option = $ 5. 6, Stock Price, Gross. A payoff graph will show the option position's total profit or loss (Y-axis) depending on the underlying price (x-axis). What we are looking at here is the payoff graph for a bear call spread option strategy. In this example the trader has sold a $355 strike call and bought a $360 strike call for a net $0.80 per contract (or $80 for a ... The profit from writing one European call option: Option price = $10, Strike price = $200 is shown below: Put Options. By now, if you have well understood the basic characteristics of call options, then the payoff and profit for put option buyers and sellers should be quite easy; simply replace \( "S_T-X" \text{ by } "X-S_T" \).

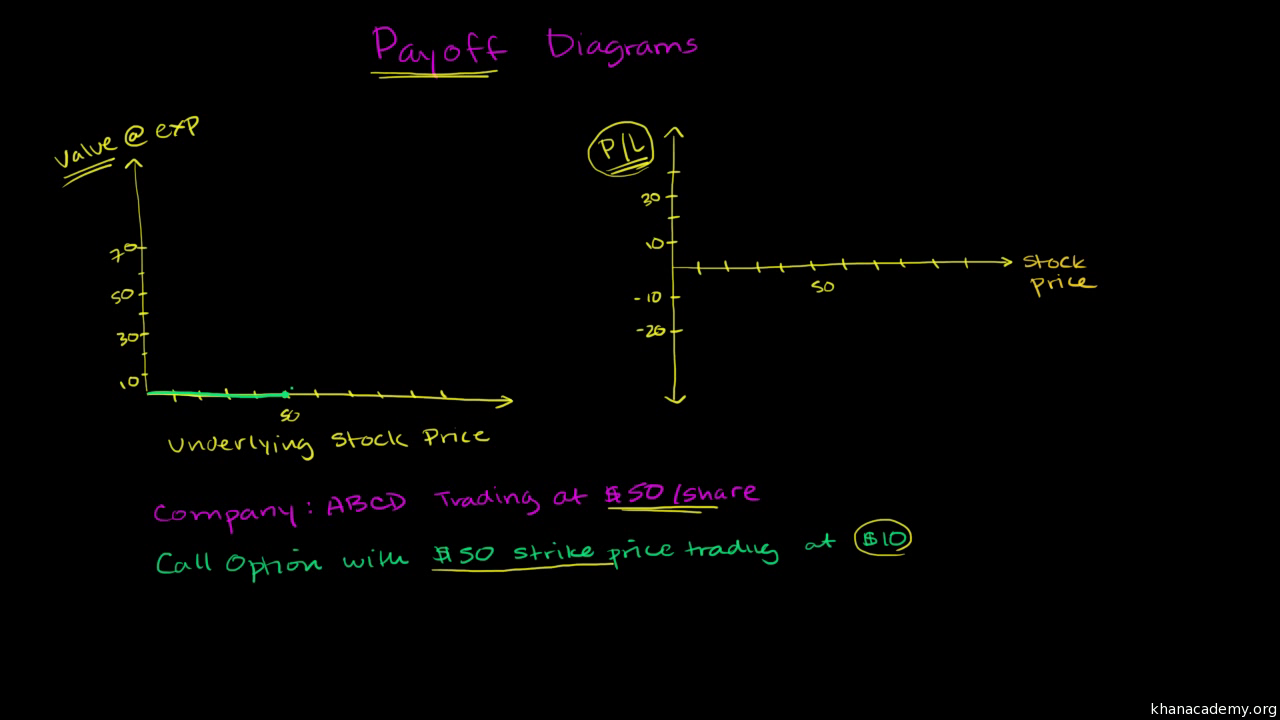

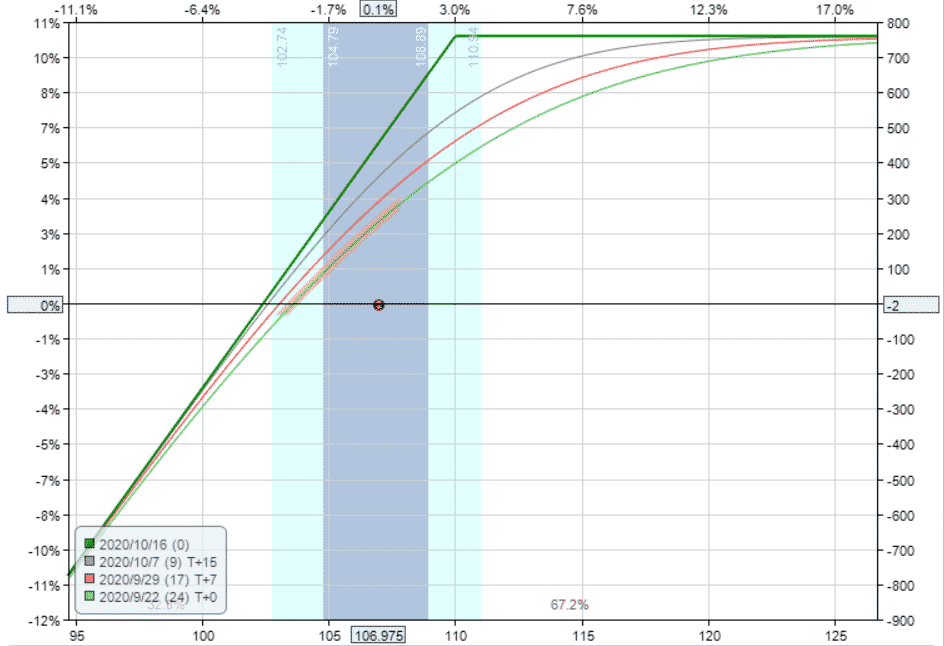

Call option payoff diagram. Binary Call Option Payoff Diagram. Binary Call Option Example. A binary options brokerage is offering 85% payout for the binary call option on EUR/USD which is currently trading at $1.30. After tracking the price movement of EUR/USD for the past hour, the binary option trader believes that the price will rise over the next 5 minutes and decides ... Transcript. A call payoff diagram is a way of visualizing the value of a call option at expiration based on the value of the underlying stock. Learn how to create and interpret call payoff diagrams in this video. Created by Sal Khan. This is the currently selected item. The below covered call option payoff is from Interactive Brokers. The covered call option was an AAPL 110 strike call sold for $4.20 per contract or $420 in total and a long position bought at $106.10 per share. The breakeven price at expiration is $101.90 (long position bought price minus premium received). For the call and put in questions 1 and 2, graph the profits and losses at expiration for a straddle comprising these two options. If the stock price is $80 at ...

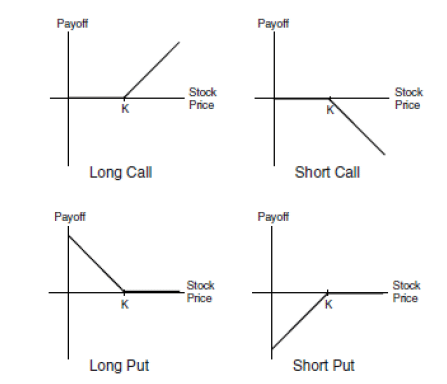

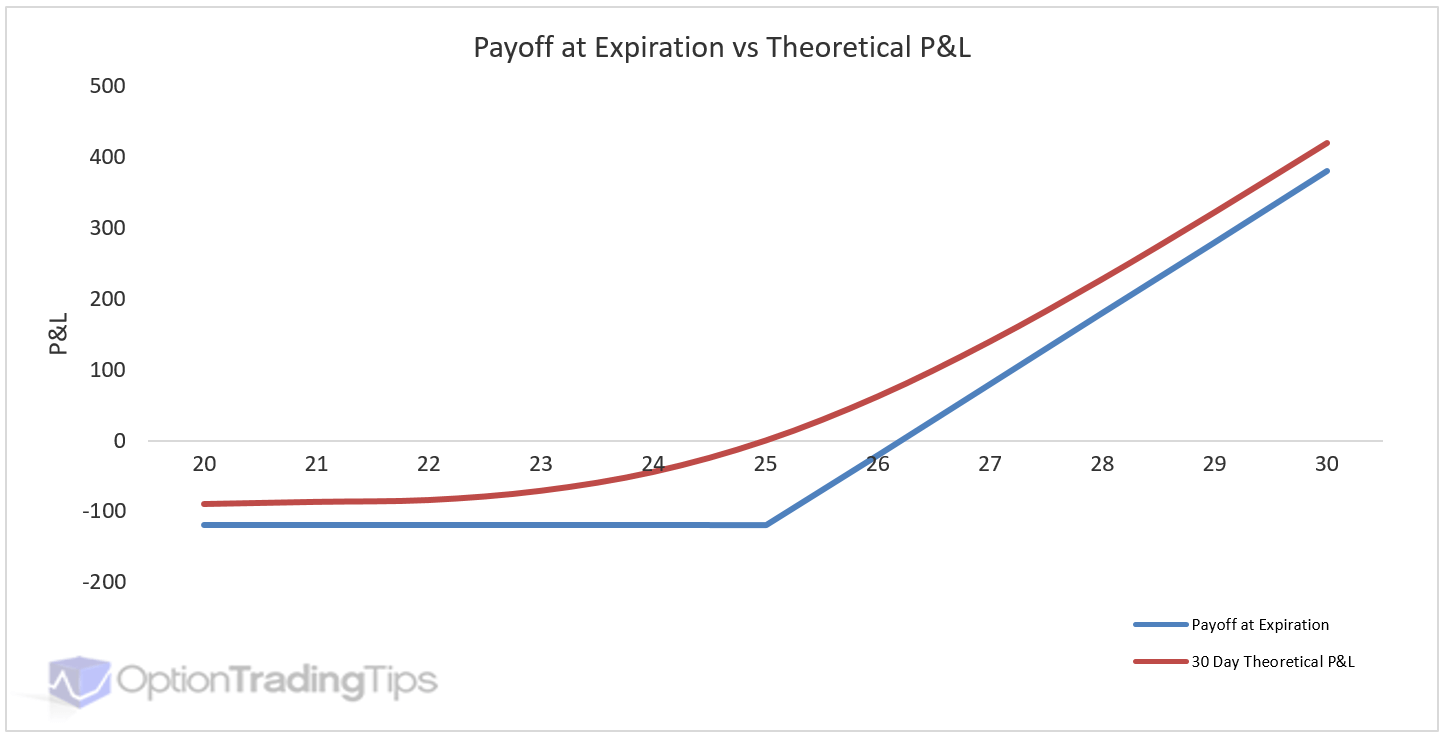

Call Option Payoff Diagram. Buying a call option is the simplest of option trades. A call option gives you the right, but not obligation, to buy the underlying security at the given strike price. Therefore a call option's intrinsic value or payoff at expiration depends on where the underlying price is relative to the call option's strike ... The payoff diagram of a put option looks like a mirror image of the call option (along the Y axis). Below the strike price of $100, the put option earns $1 ... Call Net Pay-off Graph using Excel Very easy to understand Bull Call Spread Payoff Diagram In the graph below you can see how the profit or loss behaves under the different scenarios and how the two options are driving it. The thick blue line represents overall P/L; the green line is the long $45 strike call; the red line is the short $50 call.

Now let's look at a long call. Graph 2 shows the profit and loss of a call option with a strike price of 40 purchased for $1.50 per share, or in Wall Street lingo, "a 40 call purchased for 1.50." A quick comparison of graphs 1 and 2 shows the differences between a long stock and a long call. When buying a call, the worst case is that the share ... III. EXERCISE FOR THE PAYOFF DIAGRAMS. A. CALL OPTION A call option is a contract giving its owner the right [Not the obligation] to buy a fixed amount of a specified underlying asset at a fixed price at any time or on or before a fixed date. For example, for an equity option, the underlying asset is the common stock. In the payoff diagram, a butterfly is long one 45 call, short two 50 calls and long one 55 call. It's a $5 wide butterfly strategy, meaning that the long ITM and OTM strikes are $5 away from the two short ATM options. Say an investor pays a $0.50 debit for this 45/50/500 call butterfly, and assume the stock is at $50. Understanding the payoff to the buyer of an option. When you buy an option you get the right without the obligation. A call option is a right to buy without the obligation and a put option is a right to sell without the obligation. Since the option loss is restricted to the premium paid, the maximum loss is capped at that level.

Looking at a payoff diagram for a strategy, we get a clear picture of how the strategy may perform at various expiry prices. By seeing the payoff diagram of a call option, we can understand at a glance that if the price of underlying on expiry is lower than the strike price, the call options holders will lose money equal to the premium paid, but if the underlying asset price is more than the ...

To Open your Demat & Trading account with Fyers Securities, Please click on below link http://partners.fyers.in/AP0209 Please fill in your details, Fyers rep...

Calculation of call option payoff; two alternative call payoff diagrams Value of Option at Expiry (doesn't take into account what you've ...

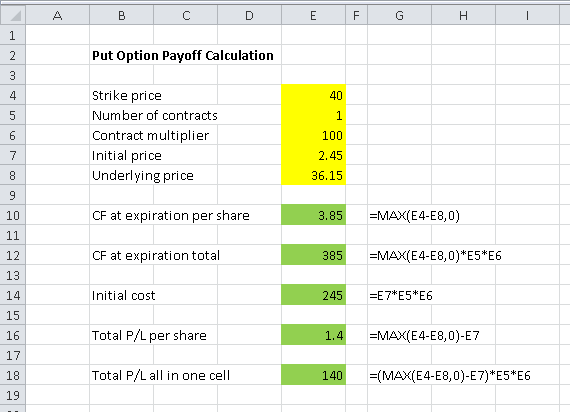

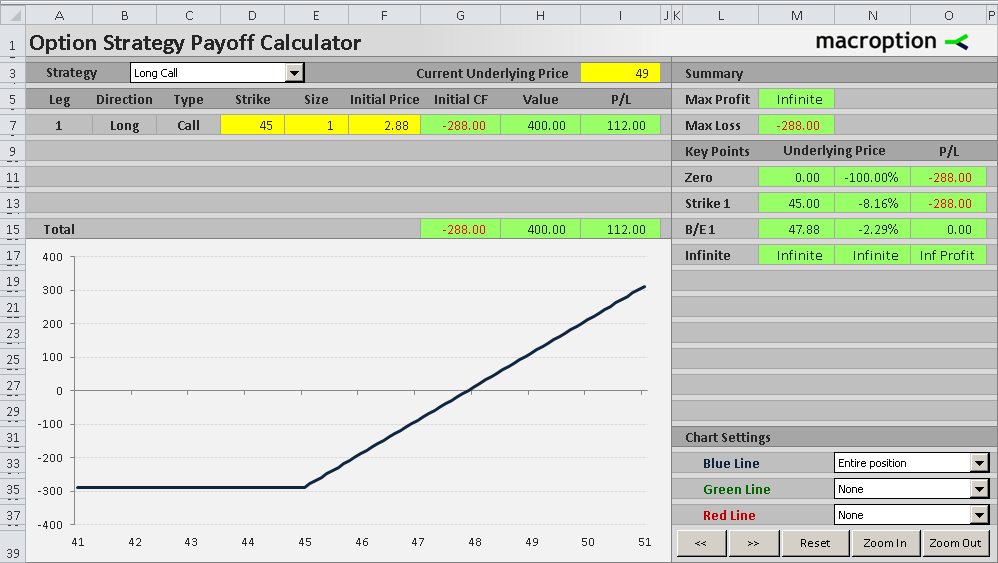

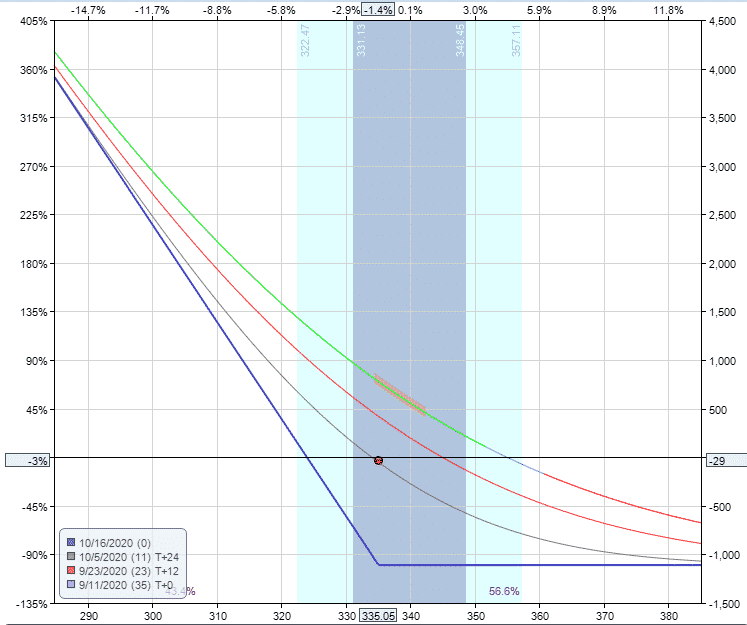

This is part 2 of the Option Payoff Excel Tutorial, where we are building a calculator that will compute option strategy profit or loss and draw payoff diagrams.In the first part we have explained the payoff formulas and created a simple spreadsheet that calculates profit or loss for a single call and put option:

Call Option Payoff Graph. Understanding payoff graphs (or diagrams as they are sometimes referred) is absolutely essential for option traders. A payoff graph will show the option position's total profit or loss (Y-axis) depending on the underlying price (x-axis). Here is an example:

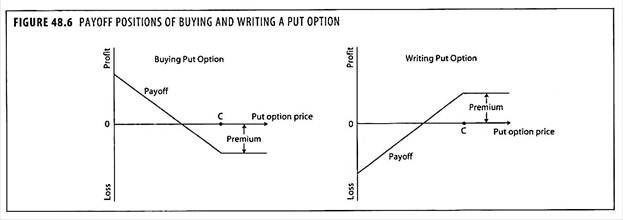

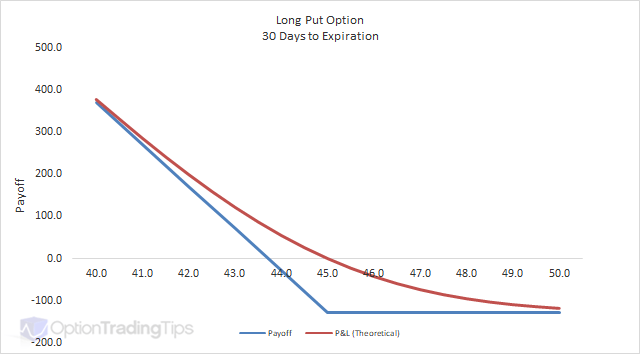

Put payoff diagram. Transcript. A put payoff diagram is a way of visualizing the value of a put option at expiration based on the value of the underlying stock. Learn how to create and interpret put payoff diagrams in this video. Created by Sal Khan.

Call Payoff Diagram. Created by Sal Khan.Watch the next lesson: https://www.khanacademy.org/economics-finance-domain/core-finance/derivative-securities/put-c...

Call Option Payoff Graph Understanding payoff graphs (or diagrams as they are sometimes referred) is absolutely essential for option traders. A payoff graph will show the option position's total profit or loss (Y-axis) depending on the underlying price (x-axis).

This page explains put option payoff. We will look at: A put option's payoff diagram; All the things that can happen with a long put option position, and your profit or loss under each scenario; Exact formulas to calculate put option payoff; Calculation of put option payoff in Excel; Calculation of a put option position's break-even point (the exact price where it starts to be profitable)

Call payoff diagram. Put payoff diagram. Put as insurance. Put-call parity. Long straddle. Put writer payoff diagrams. Call writer payoff diagram. This is the currently selected item. Arbitrage basics. ... For the owner of a call option with a $50 strike price, then the payoff at expiration ... we're talking about the value of that position. ...

According to the Payoff diagram of Long Call Options strategy, it can be seen that if the underlying asset price is lower then the strike price, the call options holders lose money which is the equivalent of the premium value, but if the underlying asset price is more than the strike price and continually increasing, the holders' loss is decreasing until the underlying asset price reach the ...

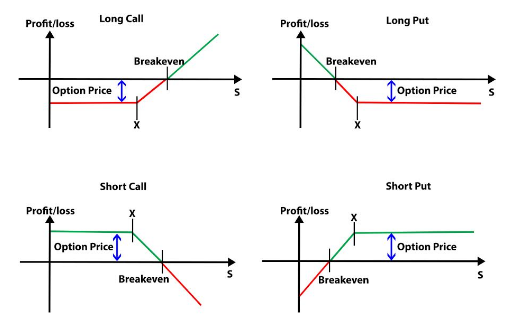

options: call options and put options. Call and Put Options: Description and Payoff Diagrams A call option gives the buyer of the option the right to buy the underlying asset at a fixed price, called the strike or the exercise price, at any time prior to the expiration date of the option. The buyer pays a price for this right.

This is part 5 of the Option Payoff Excel Tutorial, which will demonstrate how to draw an option strategy payoff diagram in Excel.. In the previous four parts we have explained option profit or loss calculations and created a spreadsheet that calculates aggregate P/L for option strategies involving up to four legs.For example, the screenshot below shows an iron condor made on strikes 45/50/55 ...

The profit from writing one European call option: Option price = $10, Strike price = $200 is shown below: Put Options. By now, if you have well understood the basic characteristics of call options, then the payoff and profit for put option buyers and sellers should be quite easy; simply replace \( "S_T-X" \text{ by } "X-S_T" \).

A payoff graph will show the option position's total profit or loss (Y-axis) depending on the underlying price (x-axis). What we are looking at here is the payoff graph for a bear call spread option strategy. In this example the trader has sold a $355 strike call and bought a $360 strike call for a net $0.80 per contract (or $80 for a ...

1, Payoff Diagram on a Call Option. 2, Current Stock Price = $ 3, Strike Price of Option = $ 4, Price of the Option = $ 5. 6, Stock Price, Gross.

Short Call Option How To Trade A Short Call Payoff Charts Explained Options Futures Derivatives Commodity Trading

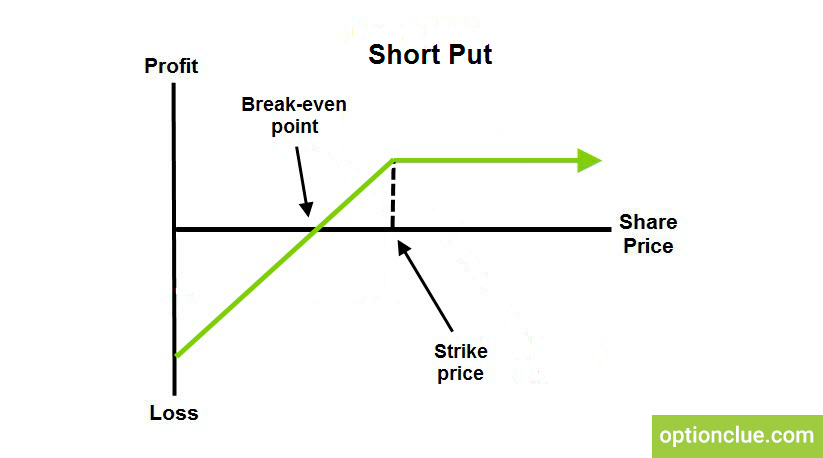

Short Put Option How To Trade Short Put Payoff Charts Explained Options Futures Derivatives Commodity Trading

Payoff Profiles Call Option Buy Long Call At Expiry Call Option Sell Write Short Call At Expiry Put Option Buy Long Put At Expiry Put Option Sell Write Short Put At Expiry

:max_bytes(150000):strip_icc()/LongPut2-3d94ffb6f6964e578b68c7ec25bd1acd.png)

/dotdash_Final_Call_Apr_2020-02-cf56d3cf2d424ade8f6001fa23883a3c.jpg)

0 Response to "38 call option payoff diagram"

Post a Comment